The Psychology of Wealth: Emotions and Investing

Gut feeling? How our emotions impact on our financial decisions

How do our emotions influence our financial planning? It all depends on our age, according to a new Kleinwort Hambros research report. The report’s survey of 400 people found that high net worth individuals (HNWIs) believe that they become less emotional about decision-making as they get older. The under-35s, on the other hand, are happy to be driven by their feelings when it comes to financial choices.

But what might this mean for our futures – and how can we prime our brains to make better decisions?

Emotionally invested

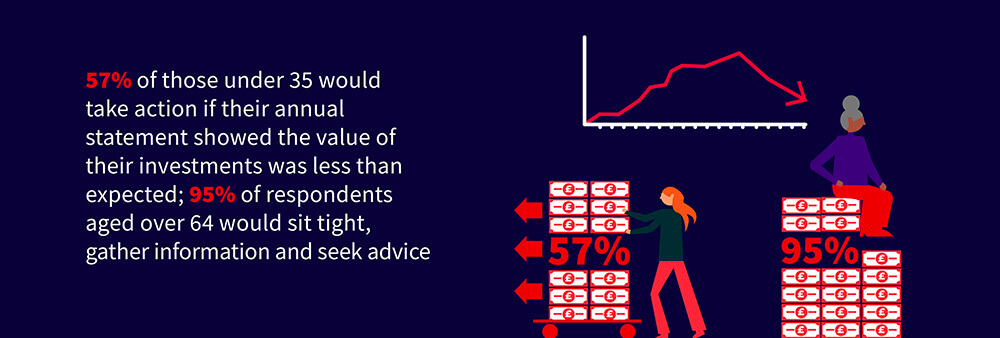

More than half of people under 35 identified in the Kleinwort Hambros survey said their financial decisions are guided by their emotions. Indeed, the difference between age groups is striking: 55 per cent of under-35s admit that emotions affect their choices, compared to 31 per cent of people aged 35 to 54, 12 per cent of 55-64-year-olds and six per cent of those aged 65 plus.

Business psychologist Natalia Ramsden says that the difference may be due to an increase in self-control as we age – but notes that other studies show our decision-making continues to be guided by our emotions, no matter how old we are. “If you look into research into emotion and decision-making, you see that emotion does have an impact on how you make decisions, irrespective of age,” she says. “The nuance may be more about how people report themselves rather than whether emotions are playing a role.”

The findings may have some role to play in how to manage money for different generations, says Ramsden. “It is important to be mindful of the fact that older individuals feel as though they are making very pragmatic, logical decisions, but that emotions are feeding into them,” she says.

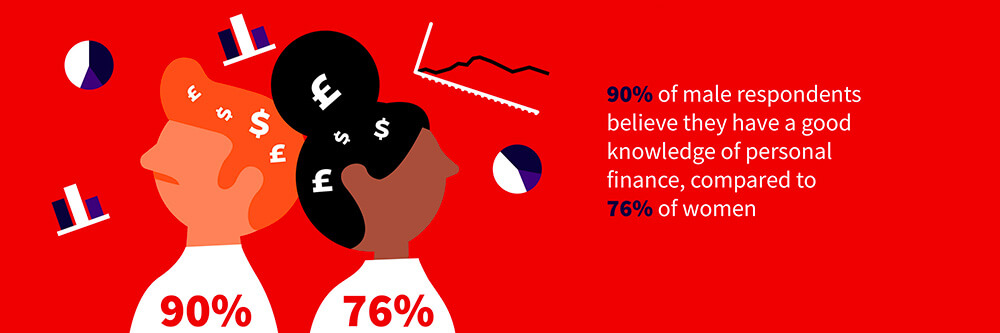

The study also shows that those with extroverted personality types are more likely to feel that their financial decisions are guided by their emotions, while those who exhibited a high level of conscientiousness in the other questions they answered are less likely to feel this.

Ramsden says she was surprised by some of the personality findings for HNWIs, with more exhibiting personality tendencies such as low extroversion and levels of openness than expected. “This group of people is a lot more complex than I might have considered from the outset,” she says.

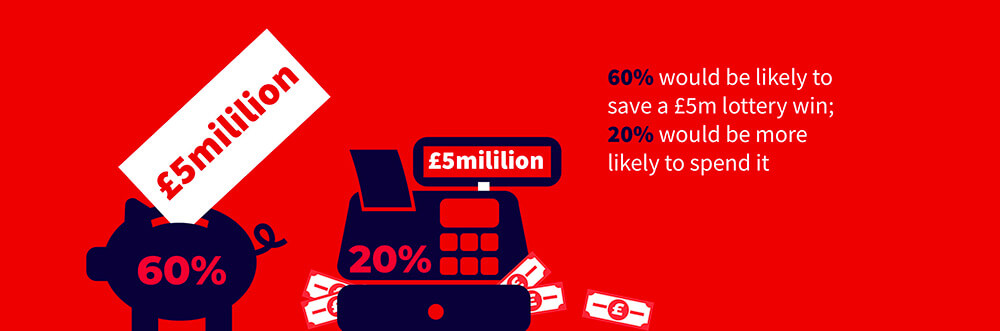

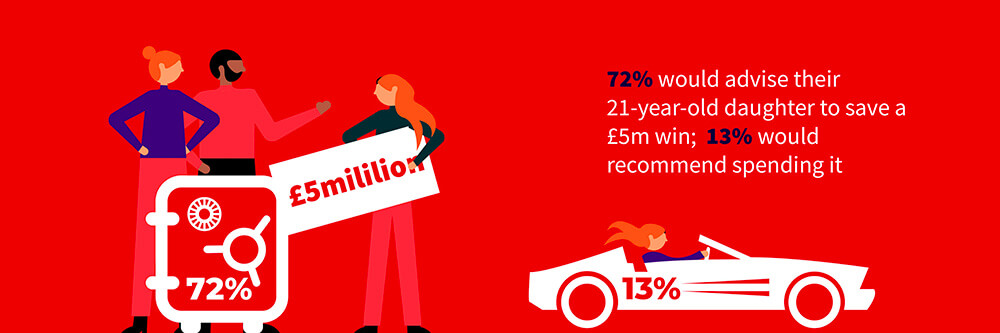

Those who are guided by their emotions would be more likely to spend rather than save if they were to receive a £5m lottery win, and would advise any children to do the same, the study shows – which may affect how they manage money.

Reassessing risk

The survey findings show that younger individuals tend to be more comfortable with risk seeking, while older individuals are less so. Across all age groups, over half stated they were happy to take risks, while 19 per cent stated that they are more risk averse, with 29 per cent in the middle.

Those under 35 are more likely to take risks, and those who are employed are more prone to risk-seeking than those who are retired.

“Over the course of a lifespan, older adults tend to be less likely to take huge risks,” Ramsden says. “They are less driven by the need for reward than younger people are, and it is linked to a decrease in dopamine in the brain. There is a declining desire to seek out these huge rewards, so they tend not to engage in risky behaviour.”

She says the fact that many people have children between 35 and 54 may affect their decision-making capabilities and risk-taking capacity.

Retraining the brain

Ramsden, whose practice SOFOS Associates trains people’s brains to be better at decision-making, says we can all retrain our minds to make us better investors.

Easy wins, such as good sleep hygiene, exercise and keeping socially active, can be combined with newer practices such as hyperbaric oxygen therapy, delivering pure oxygen to “youthen” the brain, and brain wave therapy, which changes wave patterns to modify behaviours. These combinations can make a real difference to our decision-making, she says.

“We see an increase in fluid intelligence, which is how an individual processes information and the speed of it,” she says. “Your investment decisions call on all these faculties; the things that you need with any complex decision-making are those higher-order cognitive skills.”

Ramsden believes the events of 2020 will have impacted on all our decision-making. “The pandemic has put people under extreme stress and sleep quality is not what it was,” she says. “These lifestyle factors lead into the cognitive process and to an inefficient way of processing information.”

After the stress of the pandemic – which, she says, could have physically shrunk your brain through an excess build-up of stress hormone cortisol – taking time to rebuild your brain function could be the wisest thing you do as an investor.

“It is very difficult to make clear, rational decisions when you are in that fight-or-flight mode,” Ramsden says. “Even very experienced investors often act on gut instinct – so it’s making sure there is a balance.”

Andrew Dixon, notes that this is where financial planners and the value of advice is at its most powerful although almost always underappreciated in the moment. “Advisors provide stewardship to facilitate informed decision making. Doing the rights thing at the right time is much likely to achieve your long-term objectives than any other factor. Behavioral coaching isn’t the first term that comes to mind when you think of financial planners but it is a large part of their value proposition”.

The survey for the Kleinwort Hambros research report, Wealth Planning among High Net Worth Individuals - The impact of emotions on financial planning decision-making, (October 2020) was conducted and presented by Research in Finance. Just over 400 high net worth individuals in the under 35 to over 65 age groups took part. Wealth investment parameters started at £750,000 to £1.5m plus.

Document Disclaimer

CA42Feb2021

Highbrook Media Ltd, 8 St. James’s Square, London SW1Y 4JU. 0207 525 9591. www.highbrook.media. info@hbrk.co.uk Registered in England & Wales at 2nd Floor, Stanford Gate, South Road, Brighton BN1 6SB. Registered number: 09550567