A genuine commitment to the Arts

Top of the page visual: Suzanne HUSKY, “Les oiseaux semant la vie”, 2022 - Courtesy of the Societe Generale Art Collection

Societe Generale has been present in the UK since 1871, the Group has been supporting contemporary art for almost 30 years with the creation in 1995 of the Societe Generale Contemporary Art Collection in the head office in Paris - La Defense. An overview of Societe Generale's activities in the field of art with Aurelie Deplus, Head of the Societe Generale Collection, and Laurent Issaurat, Head of Art Advisory Services at Societe Generale Private Banking.

HighClass Magazine (H.M.): Aurelie Deplus, as Head of the Societe Generale Collection, can you tell us more about it?

Aurelie Deplus (A.D.): The Societe Generale Contemporary Art Collection was created in 1995, when the Bank moved into its current head office in Paris - La Defense. Responding to the ambition to bring together the worlds of art and business, the Collection has been deployed in most areas of Paris - La Défense premises, as well as in Val de Fontenay (near Paris). The Societe Generale Collection is a living art ensemble, contemporary art being, along with classical music, one of the two pillars of Societe Generale group's cultural patronage policy. The Collection combines about 1,800 artworks of French and international artists. In fact, the images that illustrate these pages are reproductions of works that are among the Collection's latest acquisitions. As one of the largest collections of contemporary art assembled by a bank in Europe, its purpose is to be widely shared. People interested in arts, such as employees, partners, clients, students, can discover it during workshops, off-site exhibitions, etc.

Valentin VAN DER MEULEN, “Mirage 2”, 2021 - Courtesy of the Societe Generale Art Collection

H.M.: What type of art works are featured in the Collection and how are they selected?

A.D.: The Collection's philosophy is one of eclecticism, with a profound diversity of themes, artists, and creative techniques. It combines work by artists with established reputations with those of young creators, focusing on three main areas:

- painting, most of which is abstract, with artists such as Pierre Soulages, Zao Wou-Ki, or Aurelie Nemours -

- sculpture, focusing on three preferred materials: iron, bronze, and stone, with works by Wang Du, Philippe Ramette, or Jean-Michel Othoniel -

- photography, particularly on the themes of urban landscape and nature, with artists such as Stéphane Couturier, Thomas Ruff, or Vik Muniz.

Each year, new art work is selected by a committee of experts from the world of art and enlightened amateurs, chosen from among the Group's employees via an internal call for applications. Their proposals are then presented to the acquisitions committee, which includes several members of the Executive Board.

Jung-yeon MIN, “Il faut passer par là”, 2022 - Courtesy of the Societe Generale Art Collection

H.M.: How does Societe Generale's commitment to contemporary art translate in the UK ?

A.D.: The Group encourages its international entities to expand its contemporary art patronage locally. In the UK, our One Bank Street office displays a collection of approximately 40 artworks, including painting, photography, editions and prints. Attuned to a unique curatorial brief to showcase predominately artworks by female artists either working or practising in the UK, the collection aims to solidify our stance on gender balance and equality for women. All of the artists have exhibited nationally or internationally and include: Sarah Pickstone , Clare Price, Emily Allchurch, Alexis Teplin, Lubaina Himid, Sarah Jones, Phoebe Unwin, Cornelia Parker, Renee So, Terry Frost, Yves Tanguy and Phoebe Unwin. Beyond its walls, Societe Generale has been a long-standing corporate partner of the Victoria & Albert Museum.

Nabil EL MAKHLOUFI, “La Foule IX”, 2016 - Courtesy of the Societe Generale Art Collection

H.M.: Laurent Issaurat, can you tell us more about what Societe Generale calls “Art Advisory”?

Laurent Issaurat (L. I.): Art Advisory refers to a unique series of services orchestrated by Societe Generale Private Banking and mostly provided by professionals from the art world with whom Societe Generale has forged strong partnerships. These services cover a wide range of areas, from the appraisal, authentication, purchase or sale of art objects and collectibles to assistance with inventories, thinking about how to preserve or pass on assets to the next generation, insurance solutions and even the exciting subject of philanthropy and art.

Works of art and other collectors' items, beyond their symbolic or decorative value, come with wealth management challenges that rightfully deserve to be considered. This is particularly true in the United Kingdom, which is one of the greatest art markets in the world as well as a global repository for heritage and art treasures, hung on the walls of fine homes, in public or private museums, or stored in safes. However, it would be a serious misunderstanding to consider works of art as quasi-financial instruments. It is essential to appreciate the profound differences between a financial asset and a work of art.

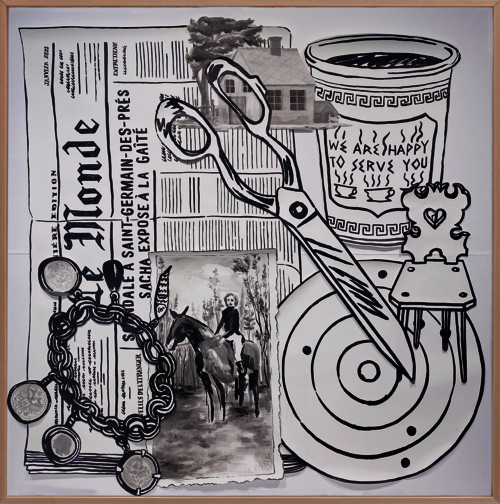

Sacha FLOCH-POLIAKOFF, “Jeu de Kim n°II”, 2023 - Courtesy of the Societe Generale Art Collection

H.M.: So, what are the differences between a financial asset and a work of art?

L. I.: The purpose of a work of art - the very reason it is created in the first place - is to provide aesthetic, emotional and intellectual pleasure. In some cases, an element of social status may also be attached to the ownership of art. All of these benefits remain highly subjective. They cannot be measured in francs, euros, or dollars, unlike the dividends or interest generated by shares or bonds. In fact, it should be borne in mind that, apart from potential capital gains on the resale of works (which are possible but remain difficult to predict), collectibles tend to generate negative cash flows, such as insurance, storage, maintenance, and restoration costs. In addition, transaction times and costs are much higher than in the financial markets, with commissions on the acquisition of works of art often exceeding 25 to 30% of the transaction value. This lesser liquidity and these costs result from the modest size and depth of the art markets in comparison with those of the financial markets. Let's not forget that financial assets are generally fungible, whereas each work of art is by nature unique, which does not favour the efficiency of the art markets, in the sense of economic theory. Moreover, in the art world, the information and regulatory protection available to buyers are far removed from the standards of the financial industry. While these characteristics are well known to collectors, they sometimes come as a surprise to novices, and therefore deserve to be highlighted. Nevertheless, works of art and collectors' items are a class of assets in their own right, representing financial stakes that are sometimes very high, and should be fully considered as part of an enlightened approach to wealth management.

Clédia FOURNIAU, “HY030”, 2022 - 2023 - Courtesy of the Societe Generale Art Collection

H.M.: What precautions should owners of artistic assets take?

L. I.: Treating art as an asset class starts with implementing a rigorous approach to acquisitions, from the identification of opportunities to the execution of the transaction, including due diligence, price negotiation and validation. It is critical to be aware of the transactional risks involved in acquiring a work of art - starting with the possibility of significantly overpaying -, and to be in a position to rely on trusted advisors in order to mitigate these risks.

Conversely, the outcome of a sale depends to a large extent on strategic decisions (defining the appropriate sales channel, target markets and customers) and operational decisions, including the choice of partners responsible for the seamless execution of the transaction, down to the logistical details. Taking all these factors into account, it is clear that being surrounded by experienced professionals is of paramount importance. In this respect, contemporary asset management plays a key role, and this is the raison d'être of art banking.

It is also paramount for the owners of works of art or collectors' items to inventory their existing assets, which are sometimes spread over several locations: main residence, secondary homes, vaults, or museums, etc. Unfortunately, we find that this crucial aspect is often overlooked, even though it is the cornerstone of the physical and financial management of a collection. Inventories also help to protect artistic assets, which require specific insurance solutions. They can also be invaluable when considering how assets should be held or passed on to the next generation.

Vincent FOURNIER, “Iceland Moon Mars Simulation #1, MS2 Spacesuit, ISE”, 2021 - Courtesy of the Societe Generale Art Collection

H.M.: What is the profile of the clients who use your Art Advisory services?

L. I.: Far from being a homogeneous group, clients using our services are very diverse: some have been passionate collectors for decades; others have no particular interest in art but have inherited objects that need to be valued with a view to possible future sale; others may be looking to make a first significant acquisition, start a collection or combine an interest in art with philanthropy. Originally focused on “fine art” objects in the traditional sense (paintings, sculptures, drawings, photographs), art wealth management now tends to broaden its scope to include all collectibles – such as furniture, wines, exceptional watches and jewellery, sports or vintage cars, rare books, and manuscripts, etc. – whenever these objects represent a financial stake. As a result, the proportion of private banking clients for whom art banking services are of particular interest will grow, and their profiles will continue to diversify accordingly.

In the United Kingdom, too, the profiles are very diverse. There are people who, in the course of their international careers, have acquired objects from all over the world, building up a kind of curiosity cabinet of objects that can be very colourful. There are also artists and their heirs, as well as art dealers.

Joon YOO, “From fear to fearless”, 2022 - Courtesy of the Societe Generale Art Collection

H.M.: What would be your final piece of advice to a client who wants to acquire a piece of art?

L. I.: Firstly, one should seek primarily emotional, intellectual, or aesthetic pleasure rather than financial return. This will put the collector in the right place in terms of art world ethics. Second, unless the client is already an insider, use reputable and trustworthy art advisors who can provide unparalleled market information and access to the best works, as well as negotiating and bargaining power. Third, once acquired, enjoy the works, but also protect, monitor, and manage their financial value over time.

CA342/October/23