November 2021 - Monthly House Views

The Bumpy Recovery Continues

Following a torrid September, global equity markets have resumed an upward trajectory. October saw gains in most regions, and this has carried on thus far in November, led by US indices which are all at or near record highs. Will the good times roll on? There are plenty of reasons for continued optimism, though, as always, risks swirl in the mix as well.

Growth is expected to remain robust in developed economies, particularly due to favourable monetary policy and financial conditions. Indeed, even as the Federal Reserve has begun its “tapering” programme, there is still $400 billion in liquidity to be added to markets before asset purchases finally cease. And at that point, we arrive at a place of historically low interest rates. Indeed, central banks globally are expected to normalise their policies only gradually, as the Bank of England recently displayed, staying its hand on raising interest rates to much surprise. This gentle policy backdrop should continue to support robust aggregate demand, which will be bolstered by the passage of a $1 trillion US infrastructure bill and may well be followed by an even larger one focused on climate and social safety-nets. Manufacturing Purchasing Managers' Indices (PMIs) for the US, UK and Eurozone remain buoyant at 58.4, 57.8 and 58.3 respectively (anything over 50 implies growth), while China's factory activity tipped back into positive territory in October also.

Might this monetary largesse and aggregate demand lead to persistently high inflation? It can, but here too we are sanguine. For the next few months, inflation will no doubt continue to surpass central bank targets: the October figure for US CPI came in at 6.2%. However, such high rates of inflation are likely to ease once temporary factors are behind us. At the root of most of today’s apparent surge is the base effect compared to where prices were at this time last year. For example, in November 2020, the price of a barrel of Brent Crude was in the $40s compared with in the $80s now; that rise is unlikely to be repeated. There were also marked shifts to our consumption patterns, with post-Pandemic consumption of durable goods 34% higher (at its peak) than before in real terms (see figure 1). Now, after having gorged on goods in lieu of services, patterns appear to be trending back to normal as Covid restrictions fade.

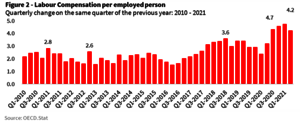

The more important single indicator of sticky, structural, and worrying inflation is spiralling wage growth, which leads companies to raise prices, thus leading workers to demand higher wages. The OECD’s Labour Compensation Per Employed Person recently hit 4.7% – very high, historically speaking (see figure 2). However, here too, it appears a peak may have been hit, or at the very least, a deceleration. The labour supply is likely to become more elastic than in recent months, as ongoing crisis-era benefits, Covid-fears and school closures are ending or abating.

However, all is far from rosy, and there are risks the market may well be under-pricing. One lurks from China’s real estate sector. In September, global markets sold off hard over the possible failure of China Evergrande Group, the world’s most indebted property developer with $300 billion of unpaid debts. Markets can have short attention spans and the furore seemed to have passed as Evergrande made payments on its dollar bonds. However, a contagion effect may be occurring and a wave of defaults among other large (and not so large) developers has since occurred. Where does this end? No one can tell. At best, it will lead to some local pain in domestic Chinese balance sheets as assets are written down in value. This is particularly true if, as expected, some form of government intervention occurs. At worst, the Asian debt crisis of the late 1990s comes to mind. This is a matter we continue to watch closely.

Bottom line

We expect economic activity to remain strong over the next few quarters, particularly in the developed world, with labour markets getting back on track and still supportive financial and fiscal conditions. We also expect inflation to return to pre-pandemic levels in 2022 in most countries.

We believe the case for risk-taking is well supported given a robust economic backdrop and still positive momentum for risk assets. Nonetheless, we are wary of expensive valuations and other risks. On balance, we are moderately risk-on with a continued preference for equities in most strategies. We do, however, also hold a stable of safe-haven assets to offset risks, particularly those from equities – which are expensive and supported somewhat by heady sentiment. These include cash, government bonds, gold, and defensive alternatives (e.g. low-volatility hedge funds, Tail Risk Protection Note).

As always, our decisions remain rooted in our investment process, the four pillars of which currently indicate the following:

- Economic regime: Our Leading Economic Macro Indicator (LEMI) suggests the global economy is in a state of expansion, which is clearly favourable for risk-taking.

- Valuations: Valuations for equities – the largest source of risk and return in most strategies – remain challenging in absolute terms. However, as we believe central banks have little appetite to raise rates at present, we remain tolerant of higher global equity valuations.

- Momentum: Global equities are in positive momentum versus their ten-month moving average. This is supportive of increased exposure to the asset class.

- Sentiment: Sentiment has fallen back into neutral territory.

We continue to constantly monitor markets. Should conditions change, particularly with the economic regime or signals from our valuation, momentum and sentiment framework, we will adjust our asset allocation accordingly.

In accordance with the applicable regulation, we inform the reader that this material is qualified as a marketing document. NR203H2/21